Some Known Details About Bankruptcy Information

Wiki Article

An Unbiased View of Bankruptcy Benefits

Table of ContentsEverything about Bankruptcy Attorney Near MeGetting My Bankruptcy Attorney Near Me To WorkBankruptcy Australia Can Be Fun For EveryoneNot known Incorrect Statements About Bankruptcy Australia Bankruptcy Benefits Can Be Fun For EveryoneThe 8-Minute Rule for Bankruptcy Information

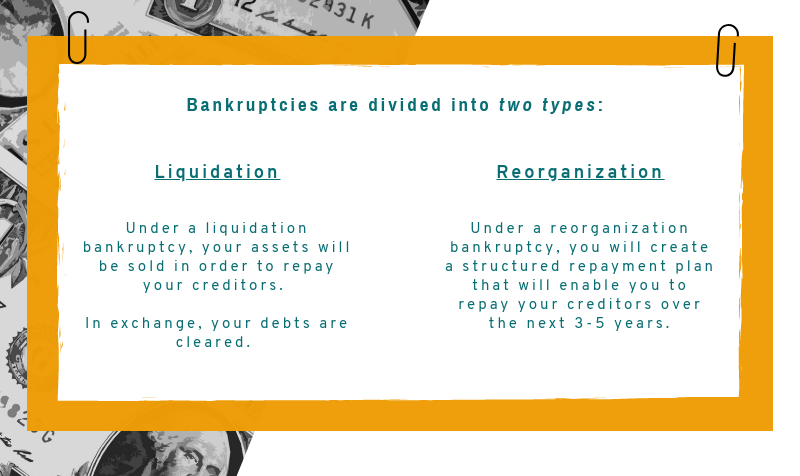

Phase 13 is commonly better to chapter 7 since it enables the debtor to maintain a valuable property, such as a house and enables the borrower to propose a "plan" to pay back creditors over time typically 3-5 years. Chapter 13 is also used by consumer debtors that do not qualify for phase 7 relief under the means examination.Chapter 13 is very various from chapter 7 because the chapter 13 debtor usually continues to be in property of the residential property of the estate and also pays to creditors, through the trustee, based on the borrower's anticipated earnings over the life of the strategy. Unlike phase 7, the debtor does not obtain a prompt discharge of financial obligations.

This publication discusses the applicability of Phase 15 where a borrower or its home is subject to the regulations of the United States and several international nations. To get more information regarding submitting personal bankruptcy, get in touch with our workplaces today. Our knowledgeable team can help you obtain a financial debt complimentary fresh beginning.

Bankruptcy Regulation in the United States is Federal Law under Title 11 of the United States Code. Those are real chapters "in the book" of the Bankruptcy Code, as well as each Chapter affords one-of-a-kind stipulations.

The 10-Second Trick For Bankruptcy Information

A Chapter 7 personal bankruptcy applies to both companies as well as people. In a corporate environment, a Chapter 7 bankruptcy is a liquidation. In the most basic terms, the possessions of the firm are sold to pay lenders according to a priority system. In a personal Chapter 7 insolvency, there is no liquidation of the person.

There is no minimum quantity of financial debt called for in order to be qualified to submit for Personal bankruptcy. All financial debt has to be provided on an Insolvency petition.

If you took a funding to acquire an automobile and also can not make your month-to-month repayments, your vehicle can be repossessed by the lender. A common timespan to be concerned regarding foreclosure would be 45-75 days delinquency. There are a number of

Examine This Report about Bankruptcy Bill

Even if you have nondischargeable financial obligation, insolvency might still be an option.You'll use the very same exceptions in both Chapters 7 and 13.

, you would certainly shed the nonexempt home, as well as the trustee selected to handle your case would certainly sell it as well as provide the earnings to your creditors., you don't lose nonexempt residential or commercial property. Instead, you have to pay lenders what it's worth through the settlement plan.

For the most component, organizations don't file for Phase 7 or 13. Rather, take into consideration Phase 11 or Phase 11 subchapter V for tiny businesses.

Facts About Bankruptcy Benefits Uncovered

Getting approved for try here Phase 13 isn't ever before simple, and also because of the various complex policies, you'll intend to work with an insolvency attorney. Until after that, you can learn more about the Phase 13 payment plan as well as get a concept concerning whether you make adequate income to cover what you'll need to pay.It's not excellent, yet it will certainly reveal you what you need to pay (you may need to pay even more). Right after you submit your "application" or bankruptcy documentation, calls, letters, wage garnishments, and also collection suits should come to a halt. It occurs due to the "automatic keep" order the court instantly puts in place.

You'll transform over bank statements, paycheck stubs, income tax return, and also other files for the personal bankruptcy trustee's evaluation. All filers will go to a "341 conference of creditors." At the meeting, the trustee will certainly examine your recognition as well as ask questions regarding your declaring. Financial institutions can appear as well as ask questions too, yet they hardly ever do.

Normally, after one year you will be discharged from bankruptcy as well as all of your debts will be written off. Personal bankruptcy deals with both protected and also unsecured financial debt.

Bankruptcy for Beginners

Its website likewise has straightforward info and guides on personal bankruptcy. In some circumstances, the High Court can make you bankrupt at the demand of a lender. This demand is made in a paper called a request. A lender can seek for personal bankruptcy against you if you have dedicated an act of personal bankruptcy within the previous 3 months.

As soon as your personal bankruptcy starts, you are cost-free of debt. Your creditors can no longer seek payment directly from you.

Any person can inspect this register. Check out much more in the ISI guide After you are made insolvent (pdf). The Official Assignee will negotiate an Income Settlement Contract or look for an Income Settlement Order for the excess of your earnings over the sensible living expenditures for your circumstance, based upon the ISI's standards.

All about Bankruptcy Court

If you acquire assets after the day when you are made bankrupt (as an example, through inheritance) the Authorities Assignee can claim them and also offer them for the benefit of your hop over to here financial institutions. If you own a family members residence, by on your own or with one more person, the Official Assignee might only market it with the previous permission of the court.If you hold residential property jointly (as an example, with your spouse) your insolvency will certainly trigger the joint possession to be split between the Authorities Assignee as well as your non-bankrupt co-owner. If the Official Assignee has actually not marketed Visit This Link your home within 3 years, possession may immediately transfer back to you, unless otherwise concurred.

Report this wiki page